The Fintech Landscape in 2025

Global Market Trends

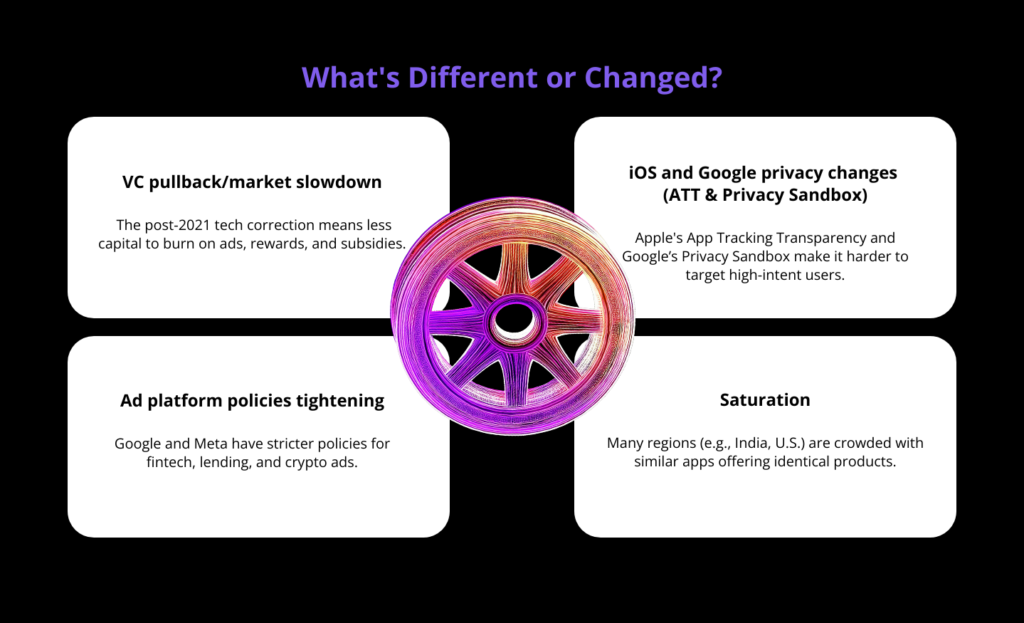

The fintech ecosystem has entered a post-hype maturity phase. Whilst overall usage continues to rise, the pace and nature of growth have shifted dramatically since 2021. Macroeconomic pressures, regulatory crackdowns, and trust erosion (especially in crypto) have reshaped what success looks like.

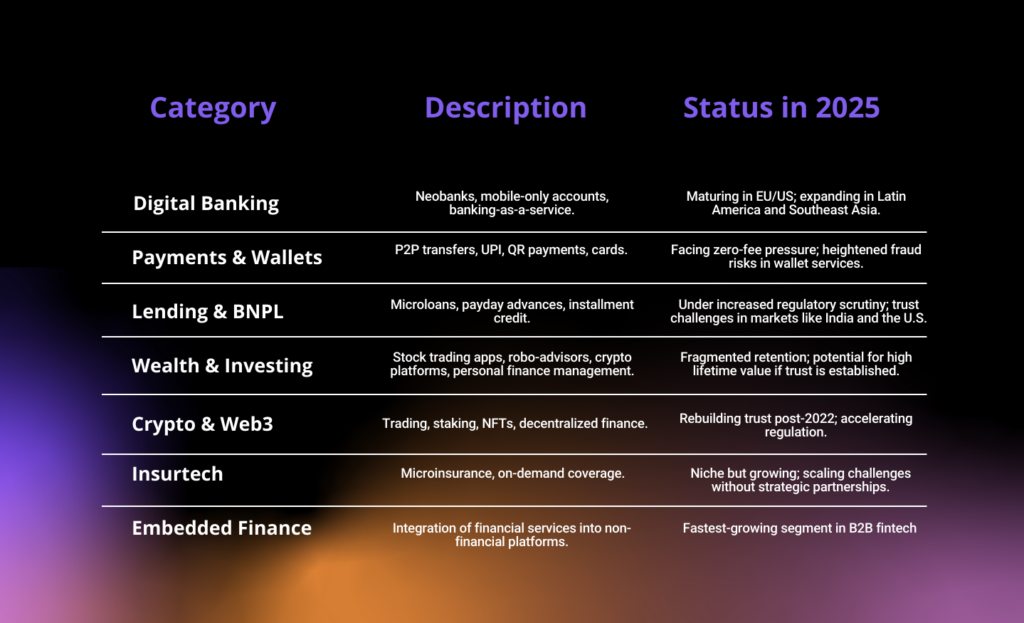

Fintech Categories at a Glance

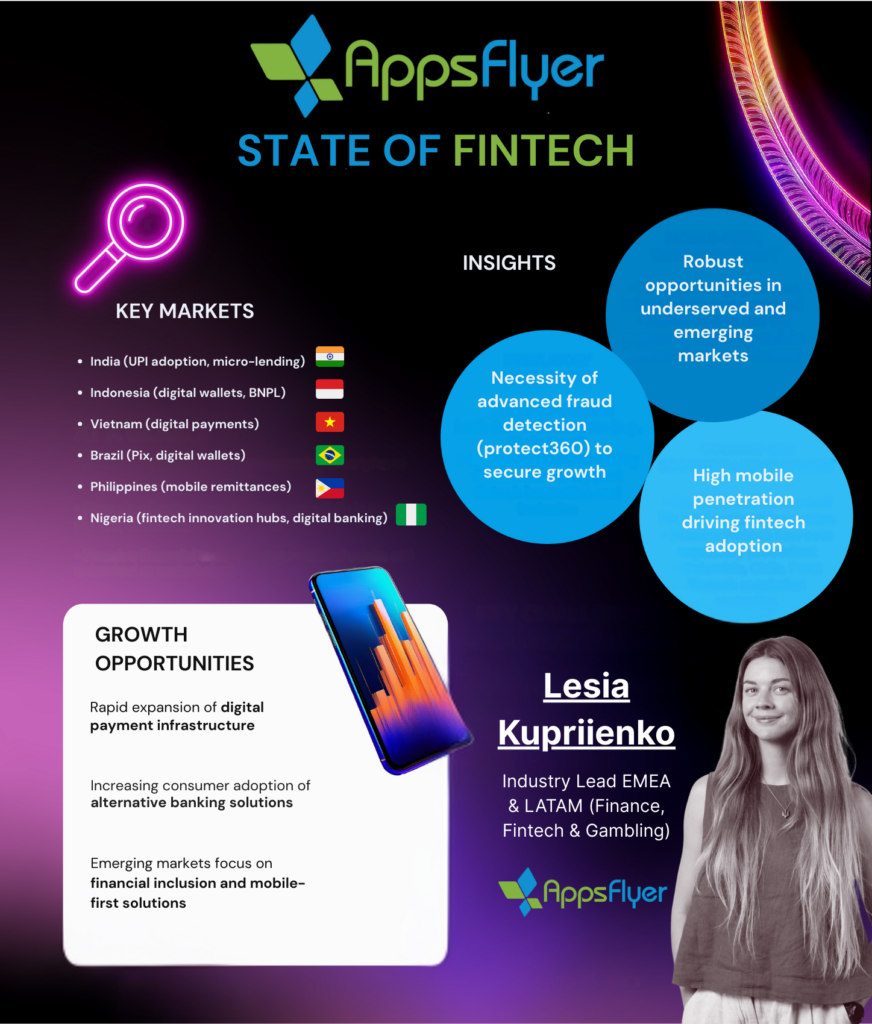

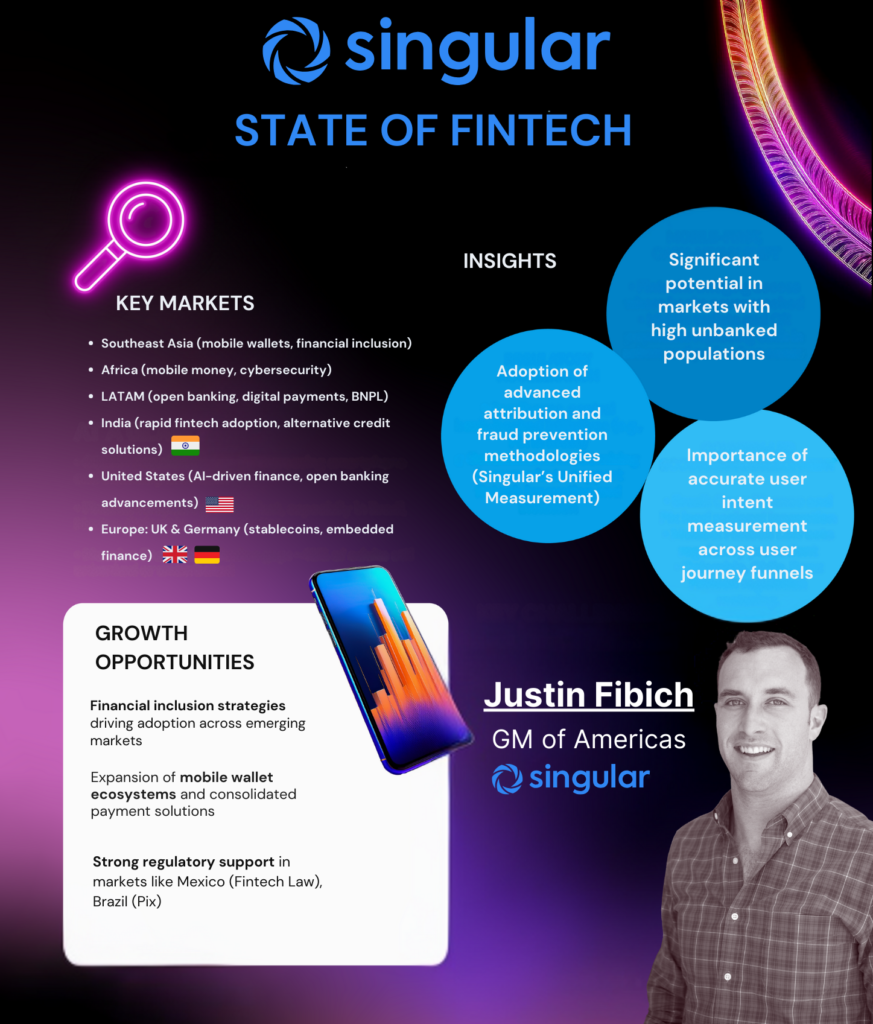

2025 State of Fintech: A Snapshot

Fintech Fraud: Detection & Mitigation

Understanding the Fraud Landscape

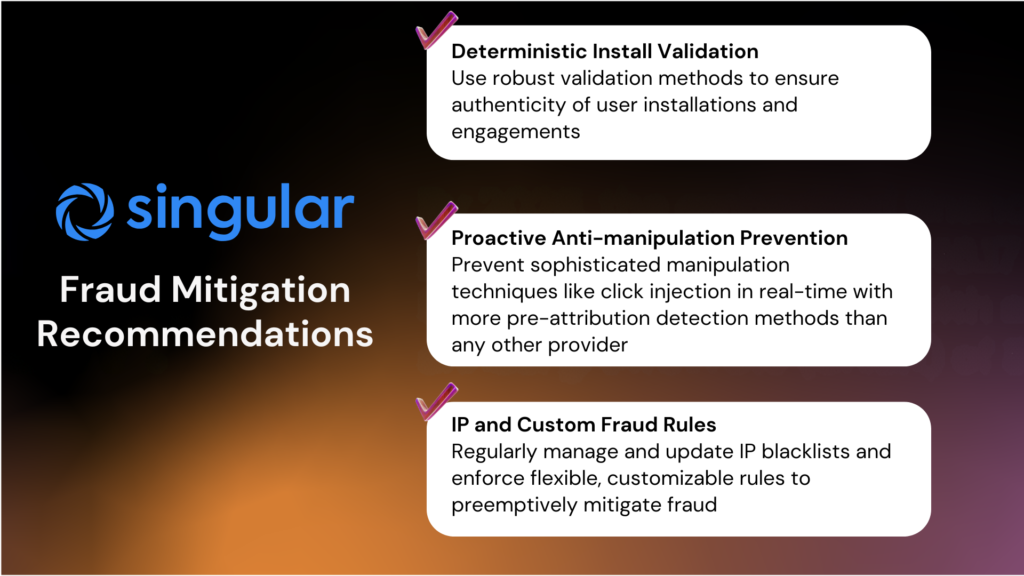

Fintech applications, by their very nature of handling financial transactions, attract significant fraudulent activity. Fraud schemes have evolved to include advanced methods such as synthetic identities, bot-generated traffic, fake user accounts, and sophisticated attribution fraud. These threats impact direct financial performance and damage user trust, compliance credibility, and the overall capacity for sustainable growth. We gathered insights from leading MMPs (Mobile Measurement Partners), AppsFlyer, and Singular to better understand the fintech fraud landscape.

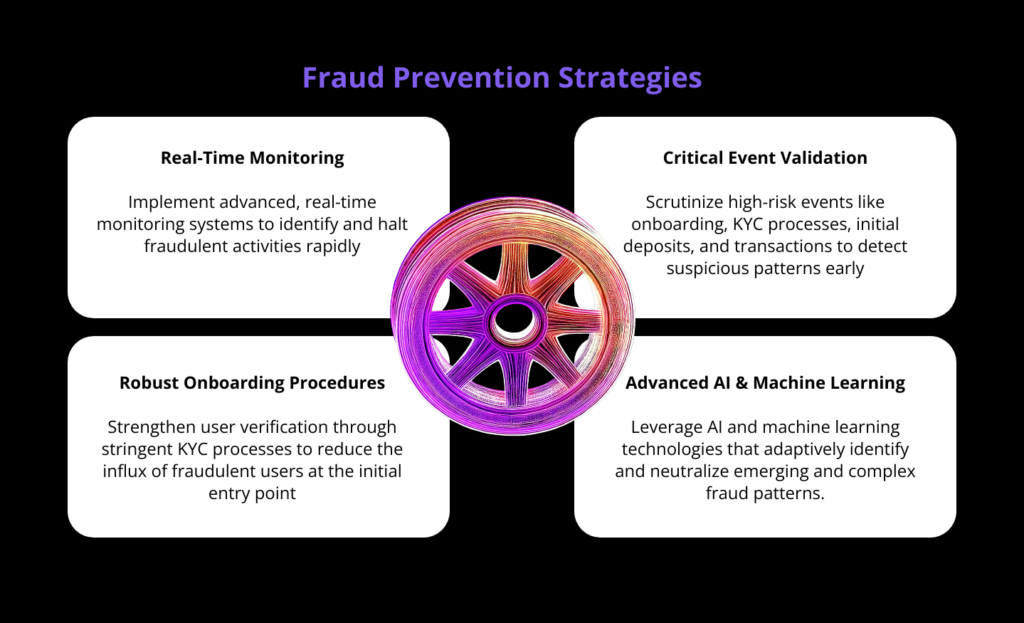

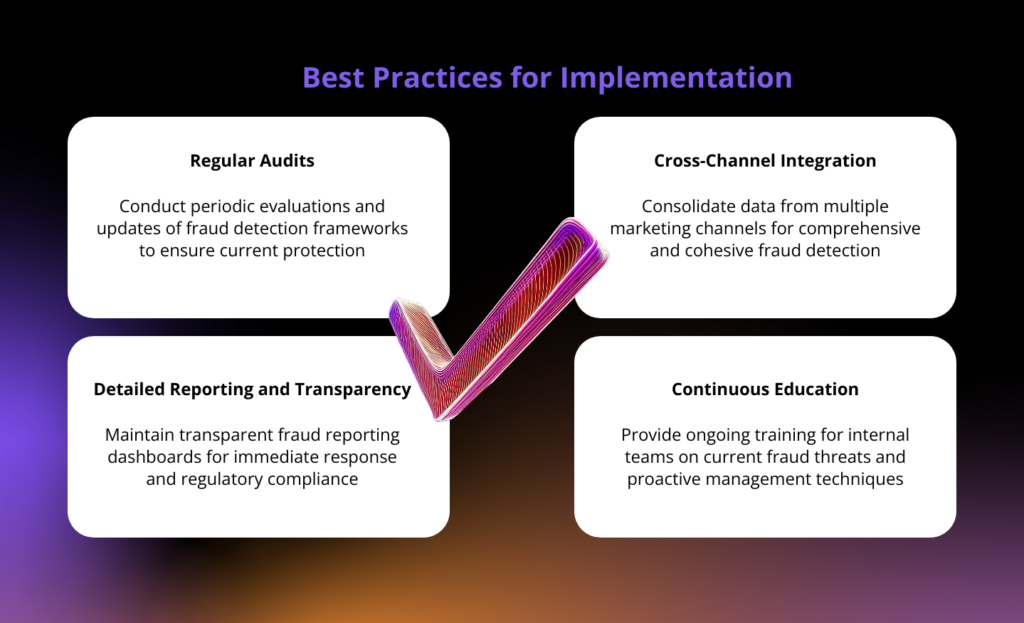

Challenges, Fraud Prevention & Best Practices

- Synthetic and Fake Users: Fraudulent actors create artificial profiles or accounts to exploit promotional incentives or mislead KPIs.

- Bot Traffic: Automated scripts and bots simulate legitimate user behaviors, complicating detection efforts.

- Click Injection and Install Hijacking: Manipulating attribution data by falsely claiming credit for installs and engagements.

- Data Pollution: Fraudulent conversions inflate metrics, distorting accurate marketing analysis and ROI.

- Regulatory and Compliance Risks: Non-compliance and undetected fraudulent activities pose substantial financial and reputational risks due to regulatory penalties.

Key Takeaways

- Effective fraud prevention is critical to safeguarding revenue, maintaining user trust, and ensuring regulatory compliance.

- A combination of deterministic and probabilistic detection methodologies offers robust protection.

- Real-time, customizable fraud detection mechanisms substantially reduce risk exposure and financial losses.

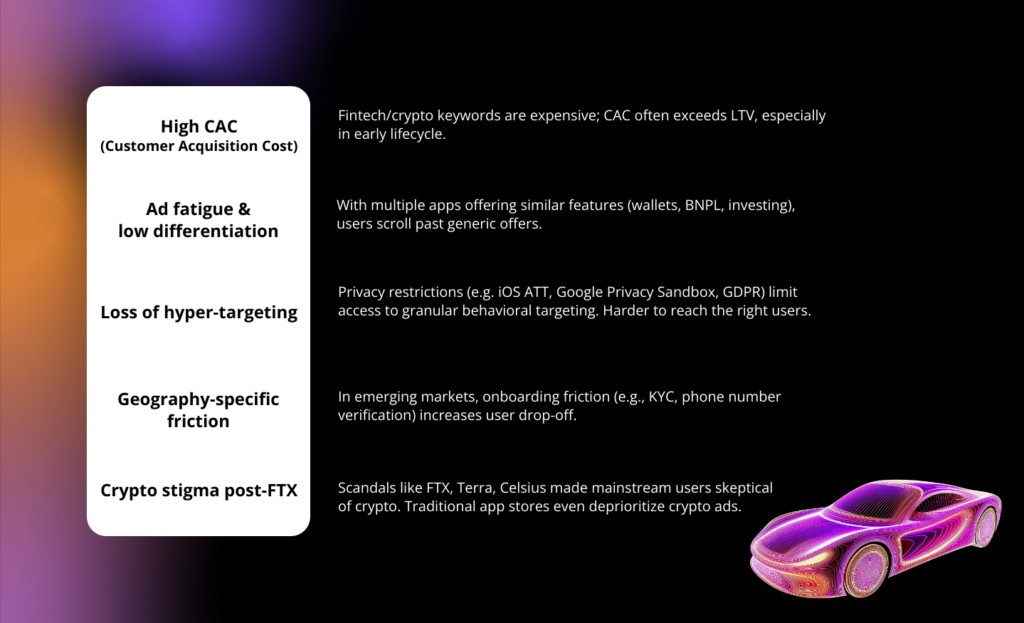

User Acquisition: Getting Users Through the Door

Key User Acquisition Challenges

Trust Deficit & Consumer Skepticism

Fallout from Scams, Shutdowns, and Crypto Collapses

Consumer skepticism toward fintech products, particularly crypto-related applications, has grown significantly following high-profile collapses (FTX, Terra, Celsius) and widespread scams. Such incidents have tarnished the entire fintech ecosystem’s reputation, making trust-building a critical but challenging priority. Fintech companies must actively address these concerns through transparency, regulatory compliance, and proactive communication.

The Psychology of Fintech Trust

Trust is not merely transactional; it’s psychological. Users must feel secure before fully embracing fintech services. Factors influencing trust include user-friendly interfaces, transparent fee structures, reliable customer support, clear privacy and data handling policies, and robust security measures. Fintech companies must build credibility proactively by addressing these psychological barriers and reinforcing their commitment to consumer safety and transparency.

Trust is Not a One-Size-Fits-All Approach

Trust perceptions vary significantly across cultures and regions. What instills trust in European users might differ in India or Southeast Asia. For instance, European users often emphasize regulatory compliance and data privacy (GDPR), while Southeast Asian users prioritize local endorsements and visible affiliations with known institutions or brands. Effective fintech strategies must incorporate localized frameworks, culturally sensitive messaging, and region-specific trust signals to resonate deeply with diverse audiences.

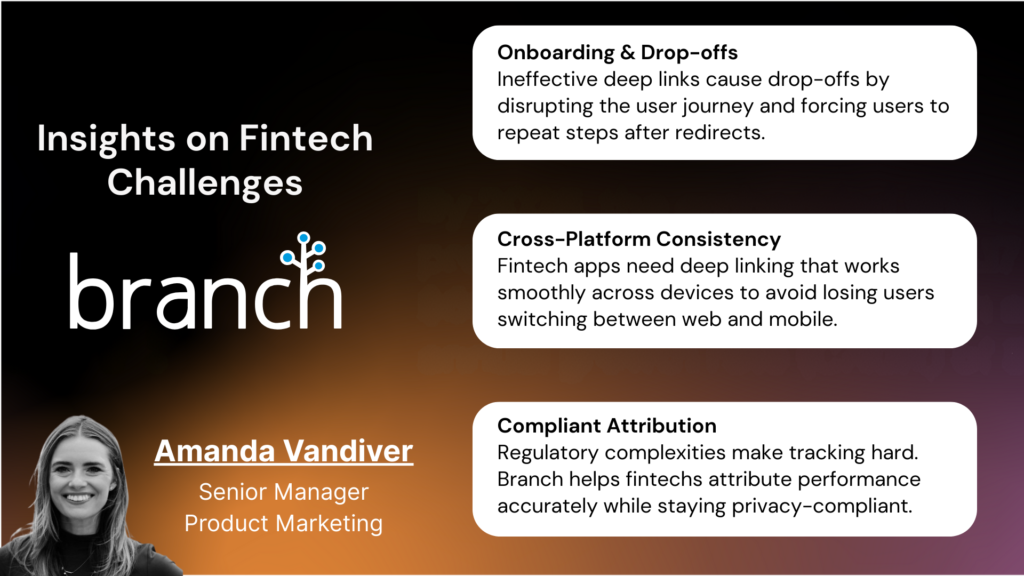

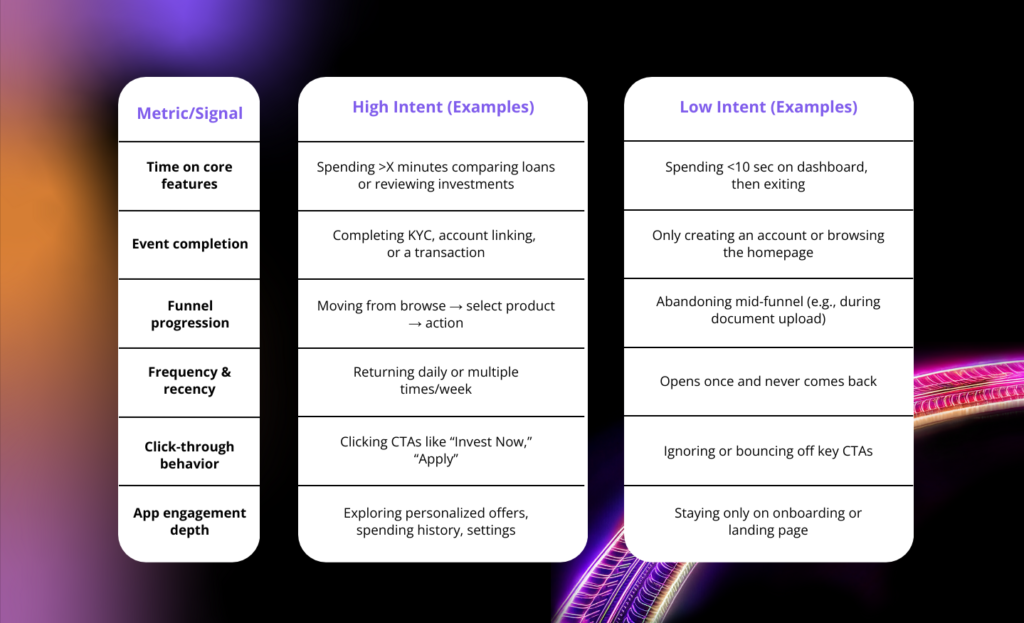

Understanding and Measuring Intent of Fintech Users

In the context of fintech apps, user intent refers to how committed, serious, or likely a user is to perform a meaningful or revenue-generating action, such as making a transaction, applying for a loan, linking a bank account, or investing. But what does that look like in practice?

How Is User Intent Measured in Fintech Apps

Intent is inferred through behavioral analytics, combining event tracking, session data, and context. Here are some key quantitative indicators you should know:

This is why having the right insights into app and advertising performance is crucial in determining what works, what does not, and, most importantly, who the high-intent users are. On some platforms, machine learning models can assign intent scores to users based on their patterns, factoring in historical behavior, time of day, device type, referral source, and even micro interactions (like hover time or scroll depth).

Sample Use Cases

Best Practices for Intent Optimization

- Regularly analyze funnel data to adapt marketing and product strategies effectively.

- Implement personalized communications aligned with users’ intent stage to maximize conversion and retention.

- Continuously refine event scoring models based on real-time data to accurately segment user intent levels.

Rethinking Paid User Acquisition

Beyond Meta & Google

Relying solely on major platforms like Meta (Facebook) and Google for user acquisition is increasingly challenging. The saturation of these channels has led to higher competition and increased costs, prompting fintech marketers to seek alternative avenues for reaching potential users. Exploring lesser-known ad networks, niche platforms, and emerging social media channels can uncover untapped audiences and reduce dependency on traditional advertising channels.

Creative Fatigue and Ad Restrictions

Users are exposed to a high volume of advertisements daily, leading to creative fatigue where audiences become desensitized to standard ad formats. Additionally, stringent advertising policies, especially concerning financial products, limit the scope of promotional content. To combat this, fintech companies should focus on producing innovative, engaging, and value-driven content that resonates with their target demographics. Utilizing interactive ads, storytelling, and user-generated content can enhance engagement and mitigate the effects of ad fatigue.

Cost of Acquisition vs. Long-Term Engagement

Balancing the cost of acquiring new users with their long-term value is crucial. High acquisition costs can be justified if users demonstrate prolonged engagement and profitability. Implementing robust analytics to track user behavior post-acquisition helps in understanding the quality of users brought in through various channels. This insight allows for the optimization of marketing spend towards sources that yield high-value, long-term customers.

Understanding AVOW’s Mobile OEM Advertising and Alternative App Store Solutions

Mobile OEMs such as Samsung, Xiaomi, Huawei, OPPO, and Vivo have developed their own app stores—Samsung Galaxy Store, Xiaomi GetApps, and Huawei AppGallery, among others—to distribute applications directly to users. These platforms offer developers alternative distribution channels beyond the traditional Google Play and Apple App Store ecosystems. By leveraging OEM advertising, fintech apps can gain prominent visibility through preload placements, featured app sections, and targeted promotions within these alternative app stores. But mobile OEOM advertising goes beyond alternative app stores. On-device display advertising and the robust targeting and advertising features available make mobile OEMs the perfect full-service advertising channel as mobile marketing evolves and adapts.

Advantages of Mobile OEM Advertising and Alternative App Stores for Fintech Apps

The AVOW Advantage

AVOW Intelligence

AVOW Intelligence, our proprietary platform, addresses the major challenges of advertising with mobile OEMs. By processing extensive data from multiple OEMs and mobile measurement partners (MMPs), AVOW Intelligence bridges the gap between media buyers and data, providing invaluable insights and real-time analysis for data-driven decision-making.

Our tool also optimizes the best OEM advertising inventory, measuring placements against key performance indicators (KPIs) and desired engagement levels. AVOW Intelligence offers a comprehensive understanding of ad placement behavior and its alignment with objectives.

Key Benefits of Working with AVOW

Putting Theory to Practice: Fintech Success with AVOW

With AVOW, fintech apps have experienced tremendous success through mobile OEM advertising and alternative app stores. With local teams in 13 global cities spanning four continents, AVOW’s international and local expertise has facilitated incredible results for our fintech clients. Here is an in-depth look at some of their success.

It’s Time to Make Vroom for a New User Acquisition Strategy

The fintech landscape in 2025 is defined by complexity: high acquisition costs, regulatory pressure, fraud risk, and evolving consumer trust. Traditional growth channels are losing efficiency, and standing out requires smarter, more compliant strategies. By tapping into AVOW’s expertise in mobile OEM advertising, fintech brands can unlock high-intent, fraud-free user acquisition across global markets — from Tier 2 cities in India to the urban hubs of Southeast Asia and Europe. AVOW’s access to untapped OEM inventory (Xiaomi, Vivo, OPPO, Huawei and more), paired with deep campaign transparency and performance focus, makes us the go-to partner for growth in the fintech vertical.

Ready to scale smarter?

Whether you’re launching in new markets, battling ad fatigue, or looking to drive more qualified installs, AVOW can help you grow faster, safer, and more efficiently.

👉 Make Vroom for a New User Acquisition Strategy

Let’s unlock the next era of fintech growth together.

About the Author