The truth about alternative app stores and mobile game monetization

When marketing your mobile app it is important to be aware of the rules, regulations and monetization methods in place for getting featured across different app stores. However, this substantial requirement can often lead to myths and common misconceptions that actually prevent developers from leveraging lucrative alternative app stores. In this article we share the truth about OEM monetization and outline how they can be leveraged to reach your marketing company goals.

Can I leverage OEMs without adopting new billing solutions for my mobile game?

Many marketers avoid alternative app stores because they believe it is mandatory to adopt a unique billing solution for each OEM. This myth prevents many developers from leveraging OEM’s untapped markets.

This misconception occurs because implementing a billing solution can be a complex process for developers which rely on in-app revenue, such as companies wanting to upload their mobile games on several app stores. If they want to run Google Play they must ensure the billing snippet works for their game. However, there are solutions available for stores such as Samsung, Huawei and Xiaomi that integrate billing solutions so that developers can publish on these stores.

When working with OEMs, companies need to negotiate a revenue share agreement between publishers and the app store owners. This can be a default rate or percentage of in-app purchases. It is therefore critical for gaming developers to look at each OEM individually and learn whether they allow Google billing.

It is not mandatory to use unique billing solutions for OPPO, Vivo and Xiaomi

Every alternative app store will be slightly different and this will affect how a billing solution is implemented. For example, if you want to run a paid promotion with Huawei it is mandatory that your app is on the Huawei App Gallery and you are required to integrate the Huawei billing solution. However, when it comes to OEMs such as OPPO, Vivo and Xiaomi’s app stores, most developers prefer to stick with Google Play’s solution to avoid the additional workload of setting up and adding several contracts with different revenue share agreements to monitor. It is not mandatory to use the unique billing solutions for these OEMs if you want to place your app in the store. For example, it is acceptable to use Google’s solution and still earn revenue from paid promotion campaigns. Moreover, if you want to advertise OEMs like Oppo, Vivo and Xiaomi there is no need to involve your developers. We can manage this process for you with the same billing solution and API.

Many developers believe they won’t monetize their inventory if installs don’t come from the Google Play Store

This is another myth that is preventing hyper casual games developers from leveraging the power of OEMs. Developers are concerned that distributing on alternative app stores will mean that their monetization is not going to be recognized by video ad companies, such as AppLovin or Unity, who sell their inventory. This is not true but it continues to make developers concerned that it will affect their build rate as a result of not being distributed by Google.

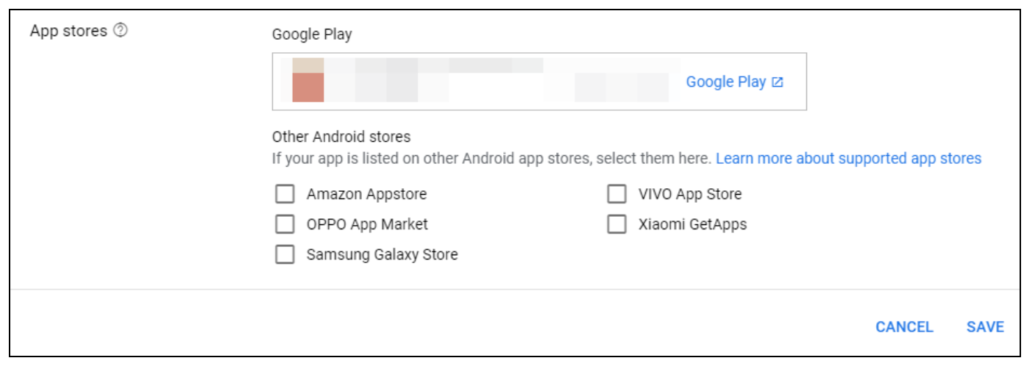

The truth is that most monetization networks do not need to consider which store the install comes from. As long as the alternative app store has no objections to distributing an app with Google Play services installed, there are no limitations from the app developers side. In fact, Google Admob has recently released an option to check OEM app stores as a distribution channel. With this in mind, you have opportunities to fill spaces for ads in your app without worrying about problems with your app’s monetization.

Above screenshot of Admob letting Developers select their method of distribution

Developers may also be concerned about the complexity of the upload and maintenance process of an app on an alternative app store, but this is technically straightforward when working with AVOW. We offer our clients an opportunity to fast track this process by publishing via AVOW’s developer account. We also offer to frequently update the respective SDK. Once you feel comfortable having enough bandwidth to do this in-house, we can easily transfer the account over to you.

From payment solutions to getting your app featured, these widespread assumptions about what’s possible with alternative app stores is preventing businesses from benefiting from the full potential of OEMs. It is always best to consult with OEM specialists about whether a particular billing system or monetization strategy is possible. This helps you unlock the untapped potential of OEMs and scale your business.

AVOW partners with OEMs around the world. We are experts in OEM mobile inventory, helping clients with a consultative approach through the whole campaign cycle. Mobile marketers can expand their reach and unlock new revenue streams with AVOW’s OEM partnerships, which covers 42% of the global Android market.

How to feature apps on Oppo and Vivo app stores

By featuring apps in alternative app stores, marketers can reach new audiences that are unavailable on Google Play and the Apple App Store. With more competition than ever before in those stores, the need to diversify the availability of your app can play a significant role in reaching your goals. Oppo and Vivo are prime examples of popular OEMs (Original Equipment Manufacturer) that have their own app stores with their own inventory you can use to scale your business. In this article we will outline how to get your app featured and the critical benefits these alternative app stores have to offer.

What are the benefits of featuring your app on Oppo and Vivo app stores?

While there are specifications for releasing your app on each app store, the time needed to meet these requirements is outweighed by the numerous benefits of alternative app stores.

Increase discoverability by targeting untapped markets: Discovery is a critical advantage alternative app stores offer marketers. These app stores are a smart way to drive growth by targeting untapped audiences. According to Statistica, OPPO shipped 24 million units in the second quarter of 2020 – continuing their significant increase in production over the past five years. Counterpoint Research found that Vivo has a 10% market share of global smartphone shipments in the first quarter of 2021.

Drive installs with incremental lift: Knowing which users are paid and organic is critical to driving incremental lift. By featuring your app on alternative app stores such as Oppo and Vivo you can drive incremental lift of paid installs. You can use Avow – which is partnered with the world’s leading OEMs – to build a relationship with users with targeting. The on-device advertising you gain is dynamic and intuitive, showing ads based on location, appographic, demographic, device type and keywords. This means you will know how users found your app and can use this critical data to drive growth. Moreover, alternative app stores offer high user acquisition and low CPI (cost-per-install) compared to Google Play and Apple’s App Store. This gives you the best opportunity to reach your targets and scale your business. You can learn more with our appographic targeting guide for OEMs.

An app store ecosystem without fraud: Mobile fraud is a legitimate concern for all marketers but alternative app stores have an ecosystem that is fraud-proof. This is because there are no additional layers between the budget holder and the alternative app store’s OEM (original equipment manufacturer). They have full control of reach advertising placement, meaning there is no opportunity for fraudsters to manipulate the ecosystem.

Increase brand awareness: Having your app featured on app stores operated by popular brands can help you build awareness and develop a positive brand reputation. For example, when users see that your app is suggested by Oppo based on their search terms and similar activity, this can generate installs by positive association.Why should I feature my app on Vivo’s app store?

With over 75 million users worldwide, Vivo has developed distribution networks across countries around the world. This includes distribution covering South Asia and countries in Southeast Asia. For example, featuring your app on Vivo’s app store has several advantages in Indonesia. Vivo accounts for 9% of the total app store’s distribution in Indonesia with more than 150 million DAUs. The OEM accounts ships 27 million units per quarter worldwide, 8 million of those selling in India.

Why should I feature my app on Oppo’s app store?

Oppo uses Heytap, a comprehensive global Internet service platform that combines with three brands: OPPO, realme and Oneplus. The app store offers powerful distribution capabilities and rich traffic sources you can leverage to drive growth. Oppo’s global expansion now covers 40 countries around the world with products sold in over 320,000 stores. The OPPO Color OS has 300 million MAUs in global markets. In the second quarter of 2020, Oppo accounted for 20.3% of smartphone shipments in Southeast Asia – putting them ahead of Samsung (19.5%), Vivo (17.9%) and Xiaomi (14%).

How is this similar to Google Play and the App Store?

Many mobile marketers gravitate to the two largest markets (Google Play Store and the App Store) but this can lead to missed opportunities with alternative app store’s untapped inventory. Ashwin Shekhar, Co-founder of Avow, explains that “alternative app stores are growing larger and larger with each passing day. As of 2019, according to the consultancy IDC, Xiaomi, Huawei, Vivo and Oppo made up 40.1% of global handset shipments in the fourth quarter, making them extremely viable alternative app stores for Android, full of untapped markets.”

OEMs are taking steps to make marketing on their alternative app stores easier than ever before. Oppo and Vivo are joining forces to create a platform for developers outside China, making it possible to upload apps onto all of their app stores simultaneously. A Reuters press release explains that “Along with Xaiomi and Huawei, these four companies are ironing out kinks in what is known as the Global Developer Service Alliance (GDSA). The platform aims to make it easier for developers of games, music, movies and other apps to market their apps in overseas markets, according to people with knowledge of the matter.” In this article we will outline how to get your app featured on Oppo and Vivo and the benefits that can help you scale your business. Nicole Peng, VP of Mobility at Canalys, says “By forming this alliance each company will be looking to leverage the others’ advantages in different regions, with Xiaomi’s strong user base in India, Vivo and Oppo in Southeast Asia, and Huawei in Europe.”

Can every app vertical be published on OPPO and Vivo?

OPPO and Vivo follow guidelines that are similar to Google Play, so these OEMs are unlikely to have any objections for apps that can be published on Google Play. If you want to publish finance/loan apps and real money gaming on OPPO and Vivo’s app stores, guidelines will depend on the restrictions per country or state.

Games developers can easily benefit from OPPO and Vivo because there is no need to negotiate a new billing system or revenue share for in-app purchases. Avow can work with the APK (Android Package Kit) available on Google Play.

What about ad formats and creative?

It is important to know the ad formats available to you when marketing your app in a new store. Here are the formats available to marketers who have featured their app on Oppo and Vivo.

- Splash screen ads: These are full-screen ads that can deliver high engagement. This format supports deeplinks and a variety of targeting labels to acquire accurate users.

- Banner ads: This format displays your ad across a banner on the user’s screen. Banner ads offer a direct download on the homepage and also supports targeting labels for accurate targeting.

- Icon ads: This includes a series of placements such as the homepage, must-haves and download recommendation pages. You can also use a search term package to acquire users without providing creatives.

- PUSH ads: This offers high impressions and supports targeting labels for accurate targeting.

For best results, you can use frequent impressions across several formats to encourage users to form brand resonance. You can also learn everything you need to know about display ads and preinstall deals with alternative app stores with our guide.

Getting your app featured on alternative app stores: How Avow can help

We are partnered with the world’s leading OEMs – including Oppo and Vivo – and our team of OEM inventory experts are devoted to helping clients access these untapped marketers. We have a consultative approach through the entire campaign cycle to ensure you can optimize your strategy and scale your business with alternative app store inventory. Access to Avow’s OEM partnerships (which covers 42% of the global Android market) enables you to expand your reach and unlock new revenue streams that cannot be accessed through social, search or SDK networks.

To learn more about Avow, get in touch with our team.

Mobile app developers can reclaim freedom of choice with alternative app stores

Mobile app developers can reclaim freedom of choice with alternative app stores

by Robert Wildner CEO & CoFounder of AVOW

Developers are losing their freedom of choice as a result of Google and Apple’s app store monopoly – but it’s not too late to leverage alternative app stores.

The Google Play store has more apps published than any other app store with over 3 million, compared to just over 2 million on the Apple App Store. While this is a benefit to Android and iOS users, the monopoly these companies have over the app ecosystem gives publishers little room to find a better deal. Once such dominance in the market has been created, the middle man gains unprecedented control over how app developers choose to run their business. To keep up with the competition, they have no choice but to shape their entire business model for mobile user acquisition for the App Store and Google Play.

There are several examples of where the app store monopoly has proved to be problematic for app developers, so it is important to look at how other markets may have avoided the issue altogether. I have learned lessons observing the value of choice. With a monopoly, one player makes a move and it affects everyone. When Epic Games released an updated version of Fortnite that side-stepped payment options in the App Store and Google Play, these companies quickly went head-to-head in a legal battle and Apple was quick to remove Fortnite from the App Store. Google and Facebook told one of the biggest games out there – with 350 million players around the world – that they could not publish an app in a way that cuts the middle men out of the payment. This is the risk of a monopoly.

But it doesn’t have to be this way: Regions such as South East Asia are a sign that there is a more balanced ecosystem that can benefit app developers. The controversy between PayTM and Google Play – whereby the app was temporarily removed from the store – has led Indian tech companies to look for alternatives. Prominent entrepreneurs in India are joining forces to create their own app store that will reduce the dominance of Google and Apple.

The mobile gaming vertical also offers examples of where the problems lie. In the case of Huawei, since they got cut from Google Play, none of the gaming developers publishing on the Huawei store can use Google Pay. They are excluded from a sophisticated payment solution that would otherwise benefit their company. So Huawei needed to find a solution. In order to make it attractive to clients, they completely waived all fees if publishers integrate the solution. This policy was split into two periods. Developers of non-gaming apps receive 100% of revenue in their first year, while mobile games get 85%. In the second year, developers get 85% of revenue and once the preferential policy is over the standard rate is 70%. Whether developers find this attractive or not, the bottom line is that the competition between Google and Huawei enabled gaming publishers to get a better deal.

It is also important to consider how GDSA will impact the mobile app market and Google’s dominance. Chinese app developers Xiaomi, Huawei Technologies, Oppo and Vivo have teamed up to provide a platform for developers outside of China. This enables them to upload apps to all of the companies’ app stores at the same time. This will play a part in diversifying what is available to publishers. A unified platform still doesn’t necessarily mean a unified payment solution but at least there is an alternative that benefits OEMs (original equipment manufacturers) and publishers.

GDSA is yet to be fully realized but it is still possible to find untapped audiences by working with OEMs and their respective app stores. These companies are taking deliberate steps to offer a true and safe alternative to the overcrowded Google and Apple app stores. Lead Analyst and Founder of MobileGroove, Peggy Anne Salz, noted the importance of OEMs in her feature for MMA: “There is a wealth of opportunity for marketers who tap the vast distribution opportunities offered by alternative app stores. It starts with a clear understanding of the unique characteristics of each app store and their business practices, and it extends to approaches that monitor app performance, track app interactions and – ultimately – ensure brand integrity.” These app stores offer a smart alternative to Google Play and the App Store while providing a fraud-free environment for advertisers. Moreover, AVOW has partnered with OEMs around the world and helps clients access these stores with a consultative approach.

Looking ahead, we should promote the benefits of a diverse market with multiple app stores and integrated payment systems. This will address the elephant in the room and enable publishers to identify the best place for their mobile apps – reclaiming the ability to choose what is best for their business.

>>> Contact us to learn more and start your campaign today! <<<

Gaming, finance, and health apps are showing huge promise in Indonesia’s mobile market

With a large population and low internet costs, Indonesia is one of the fastest-growing mobile app markets in the world, surpassing other booming app markets in Brazil, South Korea, and Malaysia. According to research firm GFK, more than 97 million devices were purchased across Southeast Asian countries such as Indonesia, Malaysia, and the Philippines in 2019. Moreover, the overall increase in mobile usage throughout Indonesia has played a vital role in creating one of the biggest mobile app markets in the world. Learning why certain apps are trending is a key step towards penetrating the market. In this article, we explore how several verticals have boomed in the Indonesian app market and how you can use OEMs to achieve your marketing goals.

Which verticals are in demand in Indonesia?

Mobile games, fintech, and health apps have emerged as promising verticals in the Indonesian app market. Apptopia revealed that gaming apps are the most installed app in Indonesia with almost 2.8 billion downloads. Finance apps came in second place with almost 1.8 billion downloads in 2019. The impact of the COVID-19 pandemic should also be considered, having had a contrasting effect on different verticals. For example, with a population of almost 270 million people and the effects of a worldwide pandemic, online shopping is now a part of everyday life for customers throughout the country. In contrast, an AppsFlyer report reveals that the demand for travel apps has significantly diminished due to the COVID-19 pandemic.

Health apps are the rising star of Indonesia’s app market

Healthcare apps such as Halodoc, Alodokter, and YesDok have increased in popularity since the beginning of the COVID-19 pandemic. These apps can help people contact a doctor if they are showing COVID-19 symptoms or have other health concerns. Even before the pandemic, health apps were finding innovative ways to help users: A 2017 survey showed that among 1012 people in Indonesia, 35% of respondents had used health apps within the past 12 months. This app vertical is attractive to users because it can help save time and money while making it easier to receive health advice and purchase medication.

Mobile games remain the most downloaded app type in Indonesia

Mobile games are helping users entertain themselves throughout the pandemic. COVID-19 has caused different demographics to familiarize themselves with gaming apps, with the average number of downloads per mobile game at more than 456,000. Social mobile games have become particularly popular this year. Head Of Content at Comunix Oren Todoros explained this global interest in an article for VentureBeat: “One of the main reasons that mobile games have made such an impact during the pandemic, beyond being an inexpensive escape from reality, is their ease of helping people stay social while social distancing.” He added that “Party games such as ‘Escape Team,’ ‘Heads Up,’ and ‘Words With Friends’ provide a great way for friends, new and old, to come together, share a laugh, and just have a good time. With the new reality of many of us stuck at home right now, these games can be a distraction and a much-needed source of laughter during an otherwise serious time.”

Fintech is rapidly changing the way Indonesian users manage their finances

There has also been a surge in demand for FinTech apps, with a 90% increase in install market share worldwide. SEA, and specifically Indonesia, has been at the forefront of disruption for banking for years and fintech is showing huge promise in the Indonesian market. The app vertical saves people the time they would otherwise spend in brick and mortar banks handling their financial services. Companies like Kredivo, Akulaku, and Julo have empowered a large portion of the population with access to credit, loans, and the basic money transfers to buy and pay online. In addition to this success, e-commerce would not have been able to thrive without fintech apps and the access to digital payment they provide. With 256 million people gaining access to the internet by 2025 in Indonesia, Fintech is not just a trend – it’s a commodity that is here to stay.

How OEMs can help you target the Indonesian app market

If you have a gaming, fintech, or a health app and want to target the Indonesian app market, working with OEMs (Original Equipment Manufacturers) offers a smart solution. This puts your app into app stores that are independently owned by OEMs, giving you access to their large untapped audience at a competitive price. OEMs offer higher user-acquisition whilst paying lower CPI (cost-per-install), and can be a particularly effective marketing method in countries where Apple and Google do not have an app store monopoly – such as Indonesia and other Southeast Asian countries. Another critical benefit to working with OEMs is that you enter a fraud-free environment. This is because there are no additional layers between the budget holder and the OEM.

>>> Contact us to learn more and start your campaign today! <<<

OEM Marketing, Solusi Alternatif Pemasaran Aplikasi di Indonesia

OEM Marketing, Solusi Alternatif Pemasaran Aplikasi di Indonesia